The Capital Market Authority (CMA) called upon relevant and interested persons participating in the capital market to share their feedback on the Draft for allowing capital market institutions to offer robo-advisory services. The consultation period will last for 30 calendar days, ending on 02/04/1447H, corresponding to 24/09/2025.

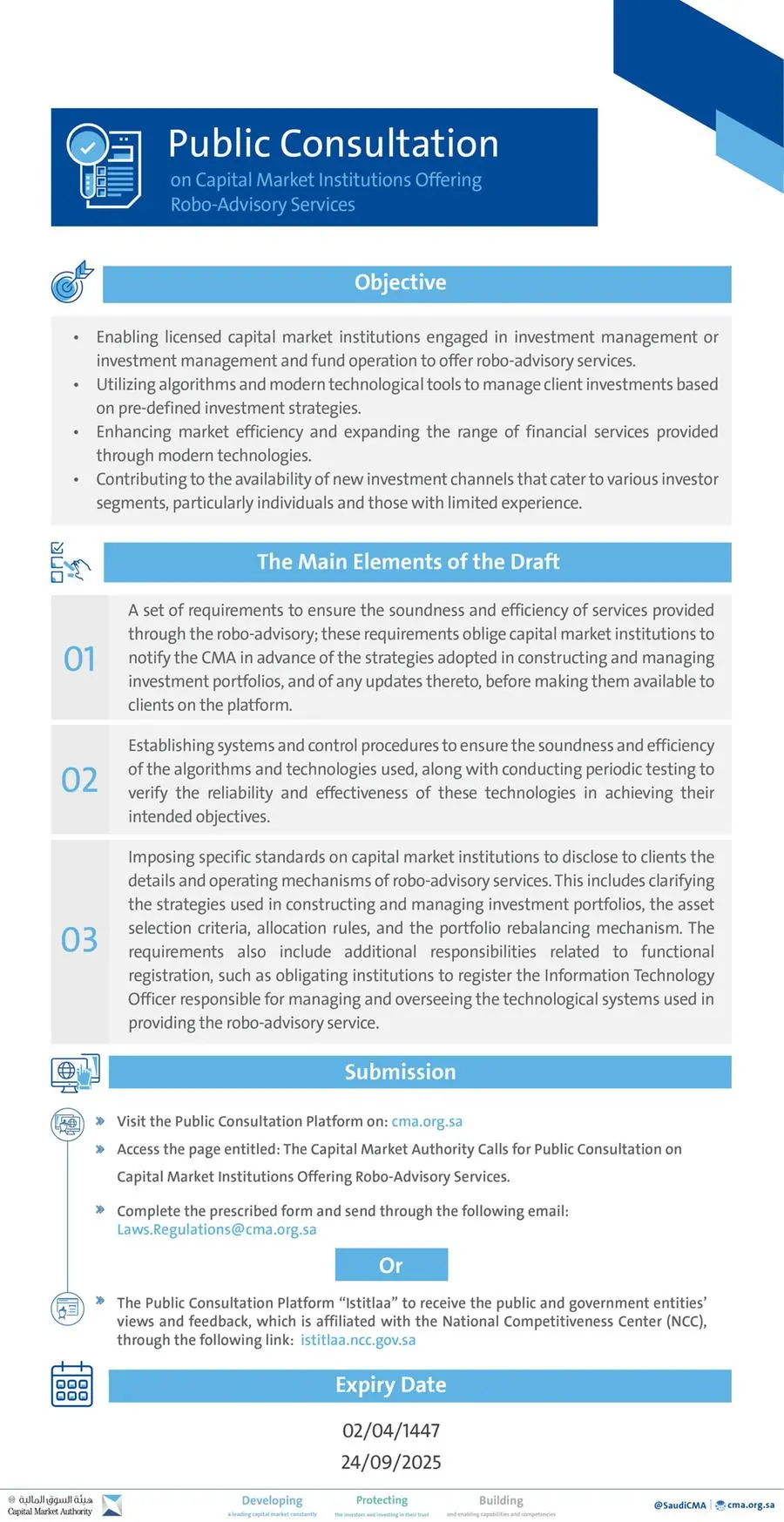

The proposed draft aims to enable licensed capital market institutions engaged in investment management or investment management and fund operation to offer robo-advisory services. This would be carried out through the use of algorithms and modern technological tools to manage client investments based on pre-defined investment strategies. The initiative aligns with the CMA’s efforts to support Fintech, provide innovative and efficient solutions for investors, enhance market efficiency, and expand the range of financial services delivered through modern technologies. It also contributes to the availability of new investment channels suited to various investor segments, particularly individuals and those with limited experience.

The proposed regulatory draft includes a set of requirements to ensure the soundness and efficiency of services provided through the robo-advisory; these requirements oblige capital market institutions to notify the CMA in advance of the strategies adopted in constructing and managing investment portfolios, and of any updates thereto, before making them available to clients on the platform. The draft also includes the establishment of systems and control procedures to ensure the soundness and efficiency of the algorithms and technologies used, as well as conducting periodic tests to verify the reliability and effectiveness of these technologies in achieving their intended objectives.

According to the proposed draft, a capital market institution licensed to conduct Managing Investments or Managing Investments and Operating Funds activities may offer robo-advisory services, provided that the investment portfolio is not concentrated in a single asset or securities issued by a single issuer. If the robo-advisory service involves securities issued or listed outside the Kingdom, those securities must be subject to the supervision of a regulatory authority with standards and regulatory requirements at least equivalent to those applied by the CMA.

The proposed amendments also impose specific standards on capital market institutions to disclose to clients the details and operational mechanisms of the robo-advisory service. This includes clarifying the strategies used in constructing and managing investment portfolios, asset selection criteria, allocation rules, and the portfolio rebalancing mechanism. In addition, the amendments define further responsibilities related to functional registration, including the requirement for institutions to register the Information Technology Officer responsible for managing and overseeing the technological systems used in providing the robo-advisory service.

The proposed regulatory amendments also include the requirement to present the performance track record of investment portfolios since inception. This includes disclosing the performance measurement standards and methodologies, as well as the total returns achieved after deducting actual expenses. These details must be published on the websites of capital market institutions. Additionally, the amendments introduce further requirements to ensure that institutions offering robo-advisory services maintain ongoing prudential requirements, in order to ensure service continuity and protect investor rights.

According to the proposed draft, robo-advisory service is defined as “The use by a licensed Capital Market Institution of algorithms and modern technological tools to manage clients’ investments based on pre-determined investment strategies, with no or limited human intervention”.

It is worth noting that assets under management through robo-advisory platforms reached approximately SAR 3.4 billion by the end of 2024, while the total number of investment portfolios by the end of the fourth quarter of the same year stood at around 382,616 portfolios, with retail client portfolios accounting for 99.76% of the total.

The CMA emphasized that the comments of relevant and interested persons shall be taken into full consideration for the purpose of approving the final Proposed Amendments, which in turn shall contribute to the aim of enhancing and developing the regulatory environment. Opinions and comments can be received through any of the following:

The Unified Electronic Platform for Consulting the Public and Government Entities (Public Consultation Platform), affiliated with the National Competitiveness Center through the following link: (istitlaa.ncc.gov.sa ).

The prescribed form through the following email: (La**************@*****rg.sa).

The Draft can be viewed via the following links:

The Draft Regulatory Framework for Robo-Advisory

Prescribed form for providing comments